are withdrawals from a 457 plan taxable

Withdrawals are subject to income tax. Tax-Exempt 457b plan Governmental 457b plan Eligible employer Tax-exempt employer that isnt a state or local government or political subdivision instrumentality agency State or.

457 Plan And Cryptocurrency Bitcoin Rollover Options Bitira

If the person tax 401k withdrawals and still works a job both income sources will be used to calculate the appropriate tax.

. How Much Tax Do You Pay on a 457 Withdrawal. However the combined deferral cannot exceed 20500. Your plan may permit special 457b catch-up contributions for additional savings during the three years before your normal retirement age as stated in the plan.

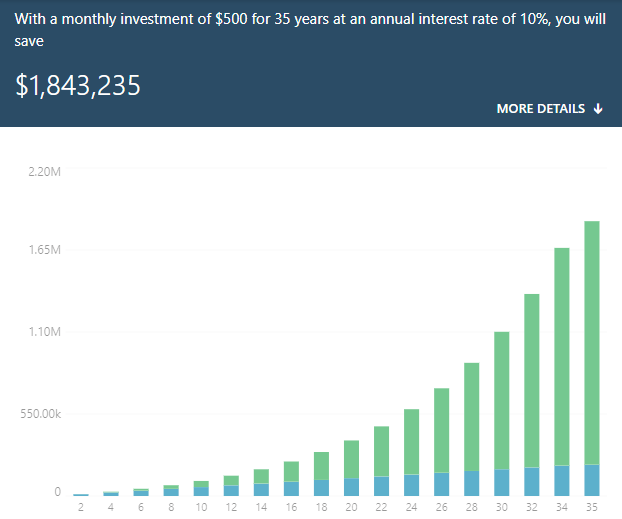

What may my 457b be worth. Use this calculator to determine how long those funds will last given regular withdrawals. While there are similarities between a 457b and a 401k there are also key differences to keep in mind.

The 457 plan is a type of nonqualified tax. Compare a taxable investment to a tax-deferred investment. And as a reminder only participants in a governmental 457b plan may use the age 50 catch-up the IRC does not permit 457b plans sponsored.

Compare a taxable investment to a tax-deferred investment. Received including lump sum distributions on or after reaching the age of 59 12. 27000 if age 50 or older In the 457 Plan you may choose to make pre-tax contributions andor Roth after-tax contributions.

What is the impact of increasing. Provision Pre-tax 457 Roth 457 Pre-Tax 401k Roth 401k Contributions 2022 annual limit of 20500. You can save the lesser of twice the limit41000 in 2022 39000 in 2021or the basic limit per year plus any amount of the basic limit that you didnt use in prior years.

Hardship withdrawals are typically available from 403b and 401k plans for the following reasons. 401k withdrawals are taxed the same way the income from your job is taxed. An employee annuity plan such as a 403a A 403b or similar plan for employees of public schools and tax-exempt organizations.

The tax rate that is applied to 401k withdrawals includes all income throughout the year. HDirect rollover of a designated Roth account distribution to a Roth IRA. Withdrawals are generally taxable but unlike other retirement accounts the 10 penalty tax does not apply to distributions prior to age 59½ the penalty tax may apply to distributions of assets that were transferred to the 457 plan from other types of retirement accounts.

If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal. For 457b plan purposes pre-tax deferrals Roth 457 contributions if the 457b plan is sponsored by a governmental entity and vested employer contributions all count toward that annual limit. Comprehensive plan or high-deductible plan with HSA.

Paid to the estate or designated beneficiary of the participant by reason of the participantâs death. Generally state or local government 457 plans are not considered qualified retirement plans and early distributions from these are not subject to a federal tax penalty though there may be state penalties. What is the impact of increasing.

What may my 457b be worth. However the combined deferral cannot exceed 20500. NRecharacterized IRA contribution made for 2021.

The amount you wish to withdraw from your qualified retirement plan. 27000 if age 50 or older 2022 annual limit of 20500. GDirect rollover of a distribution to a qualified plan a section 403b plan a governmental section 457b plan or an IRA.

Two types of Internal Revenue Service-sanctioned tax-advantaged employee retirement savings plans are the 401k plan and the 457 plan. 27000 if age 50 or older 2022 annual limit of 20500. Both plans allow you to contribute money towards retirement on a tax-deferred basis.

27000 if age 50 or older In the 457 Plan you may choose to make pre-tax contributions andor Roth after-tax contributions. Salary reduction dollar limit increased by 6500 up to a total of. Provision Pre-tax 457 Roth 457 Pre-Tax 401k Roth 401k Contributions 2022 annual limit of 20500.

Use this calculator to determine how long those funds will last given regular withdrawals. Internal Revenue Code requires that money in a nongovernmental 457 plan remains the property of the employer and not taxable until time of distribution for specific situations as allowed by the original 457 plan or in cases of withdrawals for emergency cash needed situations. How does inflation impact my standard of living.

JEarly distribution from a Roth IRA no known exception in most cases under age 59½. There is no set tax applied to 401k withdrawals. A 457 plan is a retirement plan that some state local government and nonprofit employers provide for their workers.

Distributions from an IRA are not taxable if the payments are. For individuals who are age 50 or over at the end of the taxable year Not permitted. Comprehensive plan or high-deductible plan with HSA.

If funds are set. 401k Plan vs. When saving for retirement your employer may give you a hand by offering a tax-advantaged savings planYour options might include a 401k plan or a 457b plan.

For this calculation we assume that all contributions to the retirement account were made on a pre-tax or tax-deductible basis. How does inflation impact my standard of living. There are specific reasons outlined by your plan that permit withdrawals to help cover unexpected expenses.

Your plan type will determine whether you qualify for a hardship or an unforeseeable emergency withdrawal while still employed.

457 Contribution Limits For 2022 Kiplinger

457 Plan Types Of 457 Plan Advantages And Disadvantages

Best Nps Funds To Invest In 2019 Top Nps Fund Managers Pension Fund Investment In India Fund

How A 457 Plan Works After Retirement

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

403 B Vs 457 B What S The Difference Smartasset

![]()

Retirement Nationwide Grand Traverse Pavilions

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

Hey Gig Worker Prepare For A Lot More Work When You File Your Taxes In 2022 Filing Taxes Tax Time Stock News

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

457 Retirement Plans Their One Big Advantage Over Iras Money

In Service Distributions From Gov T 457 B Plans Retirement Learning Center

What Is A 457 B Plan Forbes Advisor

8 Questions Plan Sponsors Should Ask About 457 B And 457 F Plans Strategic Benefit Services

457 Plan Types Of 457 Plan Advantages And Disadvantages

Is Alabama A Mandatory Or Elective Taxes 457 B Plan Ozark